Resident Status In Malaysia

Expatriates deemed residents for tax purposes pay progressive rates between 0 and 30 depending on their income.

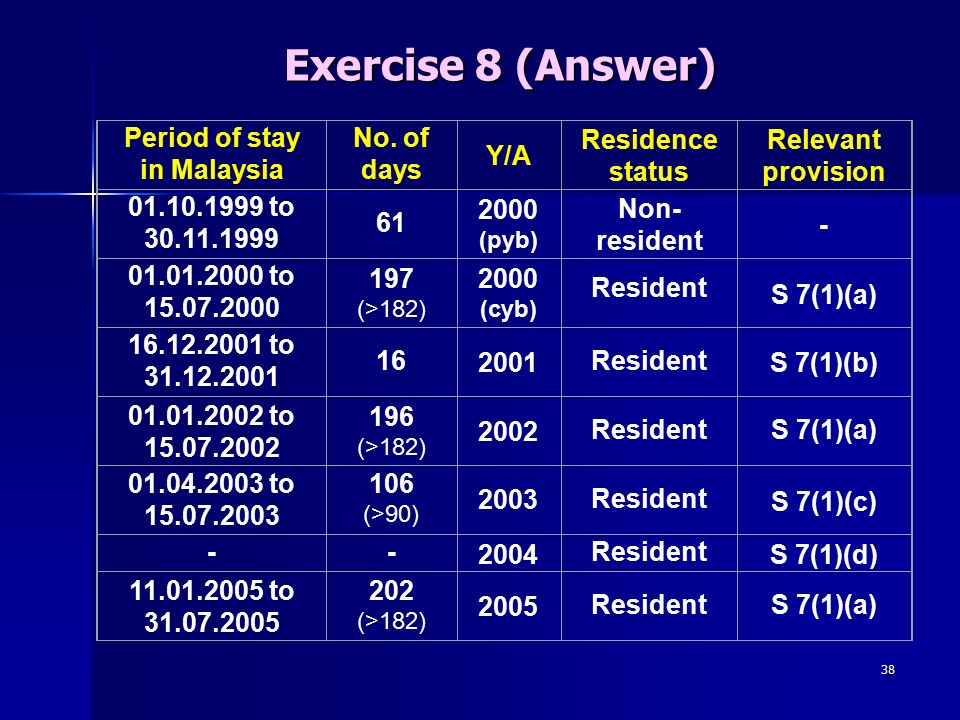

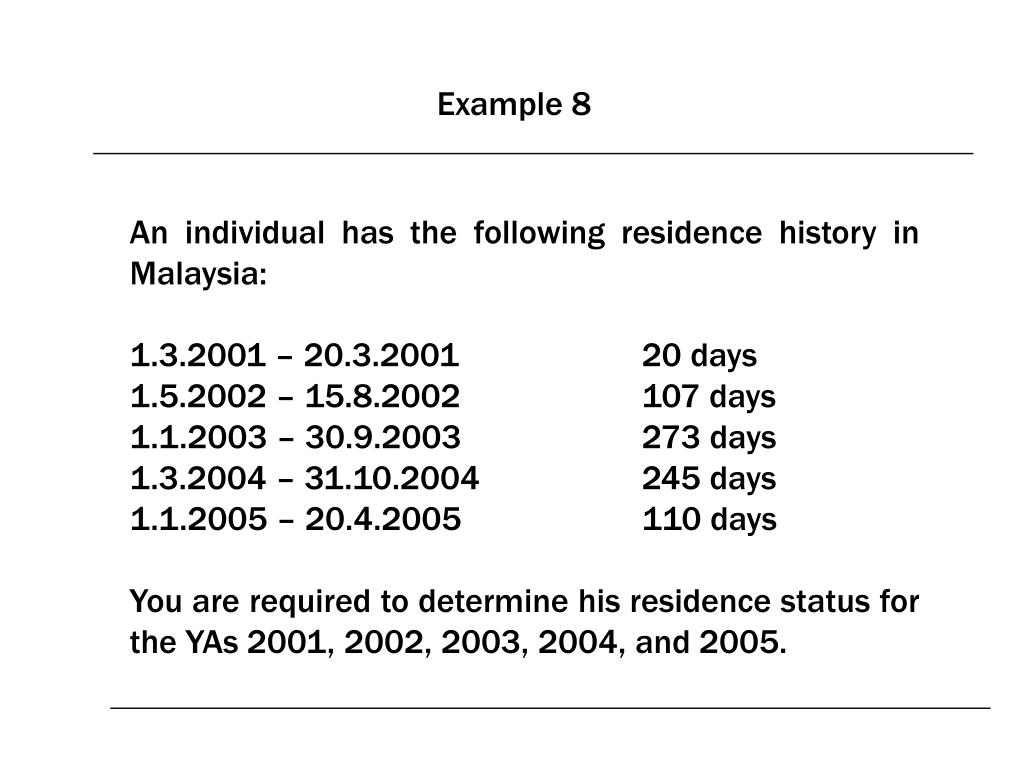

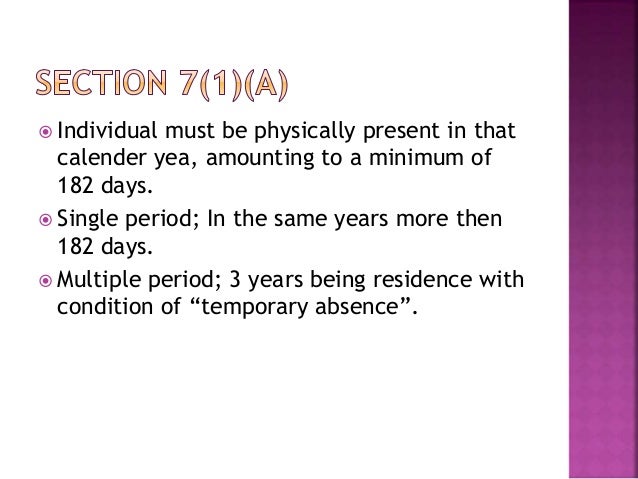

Resident status in malaysia. Determining tax residency status. 6 2011 date of issue. If an expatriate lives in malaysia for 182 days or more in an assessment year they will be considered a resident for tax purposes. Obtaining a permanent residency in malaysia will definitely take time and effort.

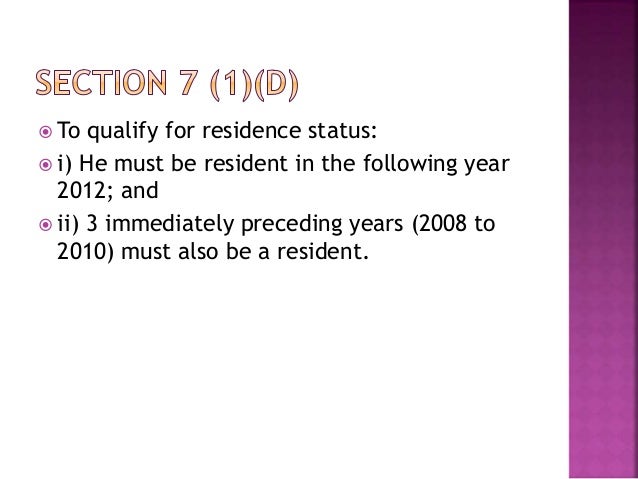

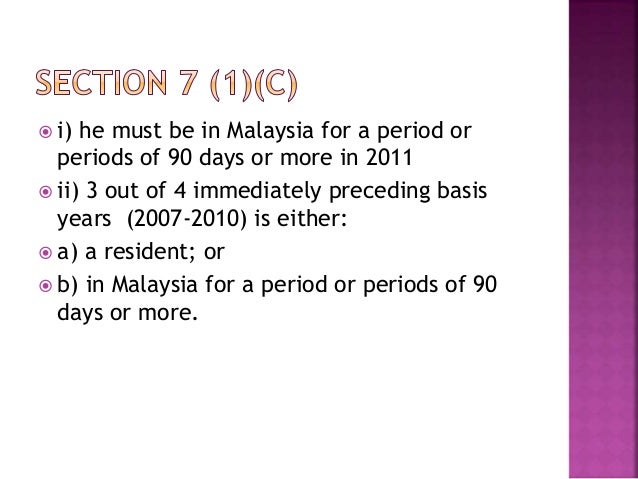

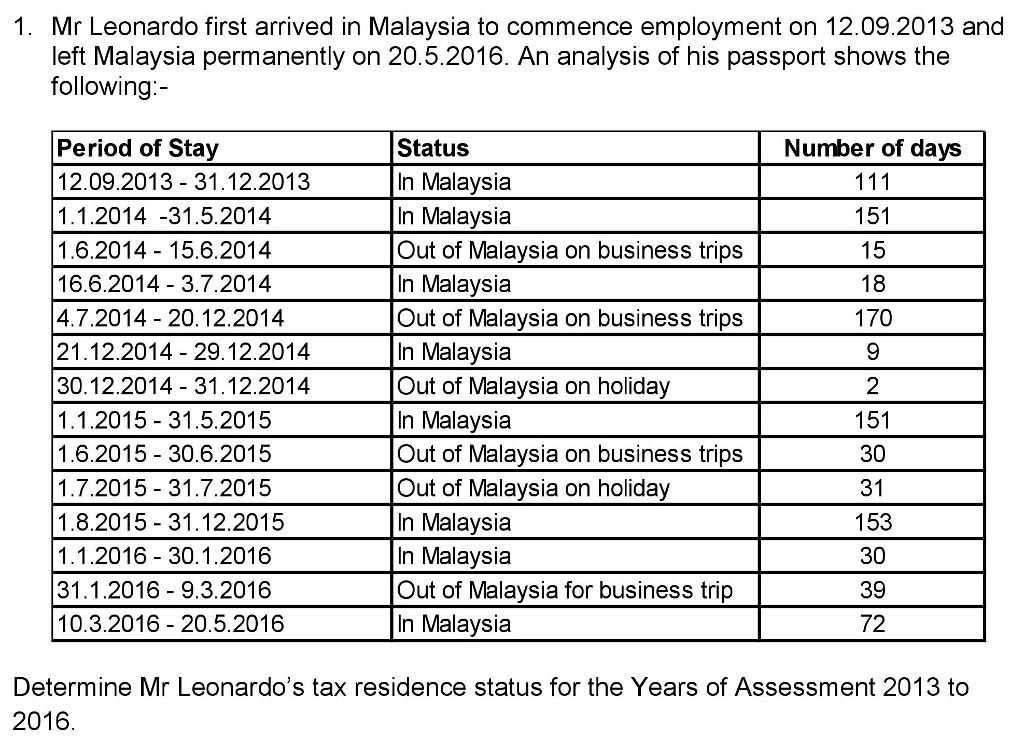

The status of individuals as residents or non residents determines whether or not they can claim personal allowances generally referred to as personal reliefs and tax rebates and enjoy the benefit of graduated tax rates. Non resident individual means an individual other than a resident individual. A page 6 of 19 anil was a non resident in malaysia for the basis year for the year of assessment 2010 as he was present in malaysia for less than 182 days in the year 2010. The cor is applied for in person with tax authorities and the employee must present their passport and documentation of travel in and out of malaysia for the past year.

Inland revenue board malaysia residence status of individuals public ruling no. The resident status of an individual will determine whether such individual is liable to malaysian income tax. The certificate of residence cor is issued to confirm the residence status of the taxpayer enabling them to claim tax benefit under the dta and to avoid double taxation on the same income. Resident individuals is defined as an individual resident in malaysia for the basis year for a ya as determined under section 7 and subsection 7 1b of the act.

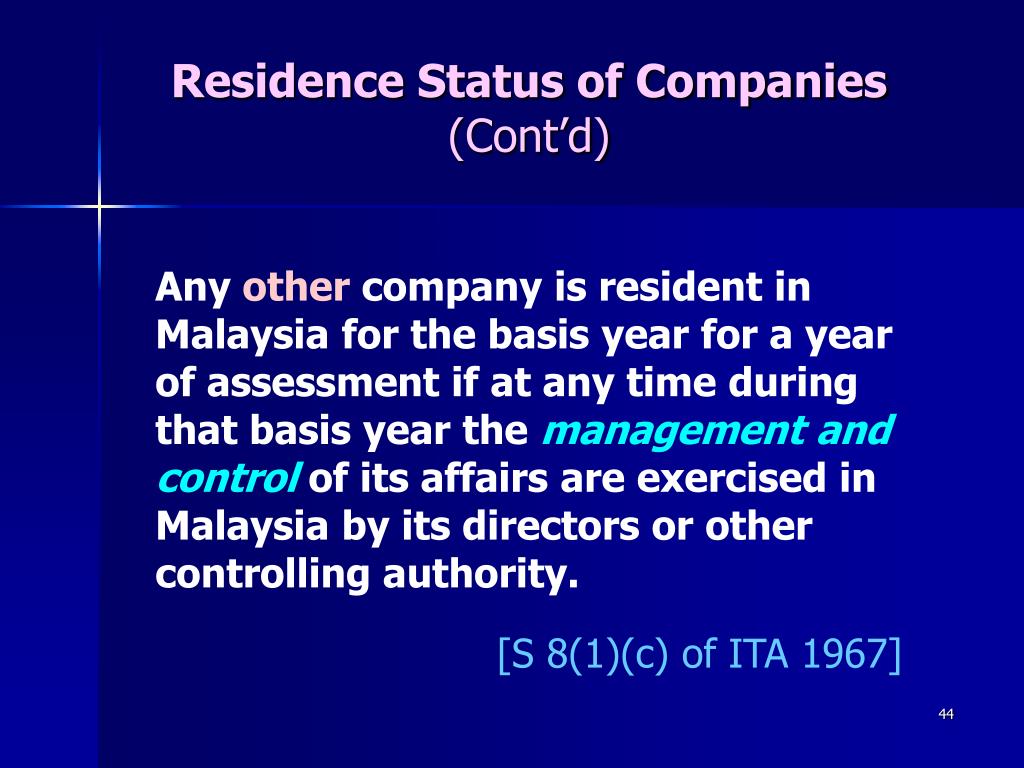

They are also eligible for tax deductions. The residence status of a director does not determine the residence status of a company. 16 may 2011 issue. Determination of the residence status.

Residents and non resident status will give a different tax regime on income earned received from malaysia. Having said that the hassle free immigration requirements and a few citizen like benefits that come with the pr status will be worth the endeavor for those wishing to make malaysia a second home. Generally residence status for tax purposes is based on the number of days spent by the individual in malaysia and is independent of citizenship. The certificate of residence cor is used to verify your tax residence status and can allow you to claim credits under tax treaties with malaysia.

Under malaysian tax law both residents and non resident are subject to income tax on malaysian source income. Resident status is determined by reference to the number of days an individual is present in malaysia. Residence status of trust bodies pursuant to subsection 61 3 of the ita 1967 a trust body is deemed a resident in malaysia for the basis. Hence a cor is issued for these purposes and with malaysia s treaty partners only.